Forecast: Ethereum could surpass bitcoin in January 2025 – what’s in store for the cryptocurrency market?

Forecast: Ethereum could surpass bitcoin in January 2025 – what’s in store for the cryptocurrency market?

In recent weeks, the cryptocurrency market has seen significant movement towards Ethereum. One of the leading analysts, Michael van de Poppe, has predicted that Ethereum could strengthen significantly against bitcoin in the near future. His forecast includes the probability that the ETH/BTC exchange rate will overcome the important psychological level of 0.4, which will become a catalyst for the growth of not only ether, but also many altcoins that operate on the Ethereum ecosystem.

Current market situation

At the time of publication of this article, the ETH/BTC ratio stands at 0.0356. However, according to van de Poppe, this ratio may grow, which is facilitated by two key factors: inflows of investments in Ethereum and outflows of funds from bitcoin. The main reason for the growing interest in Ethereum, according to the expert, is the consolidation of quotes of the very first cryptocurrency, which will create optimal conditions for the growth of demand for altcoins in the ether ecosystem.

Inflows and outflows in Ethereum and bitcoin

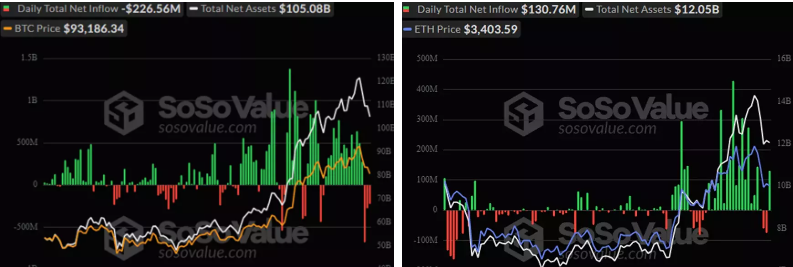

Recent data shows significant changes in capital flows between various cryptocurrency assets. On December 23, $130.8 million was invested in spot Ethereum-ETFs after two days of outflows. In comparison, over the previous 18 days, investors directed more than $2.45 billion into ETH-ETFs.

On the other hand, spot bitcoin-ETFs continue to experience outflows, with $226.6 million withdrawn in the past three days alone, bringing total outflows over that period to $1.18 billion.

Steaking as a growth driver

The market continues to actively discuss the possibility of staking for Ethereum. The inclusion of this feature in Ethereum-ETF may become an additional catalyst for the growth of ether prices. Forecasts voiced by experts such as Nate Geraci (President of The ETF Store) and Ruslan Lienha (top manager of the YouHodler platform) confirm that further additions to ETH-ETFs will support the cryptocurrency’s growth.

In this regard, many experts, including analysts from Bernstein, argue that Ethereum’s success in staking and ETFs could take the second most capitalized cryptocurrency to new all-time highs. This opens up interesting prospects for investors looking for opportunities to diversify their portfolio.

Forecasts by Michael van de Poppe and other crypto market analysts point to the possibility of a significant strengthening of Ethereum against bitcoin in the coming months. The current situation with inflows into the ETH-ETF and outflows from the BTC-ETF could be the basis for a new rally in the altcoin market. Investors who follow the developments in the cryptocurrency ecosystem can expect interesting opportunities to increase their investments in Ethereum in early 2025.

We provide active and passive management services for a variety of asset types, including cryptocurrency, traditional investments, venture capital and financial market trading. Our experts develop a strategy that fits your goals, risk profile and financial capabilities.