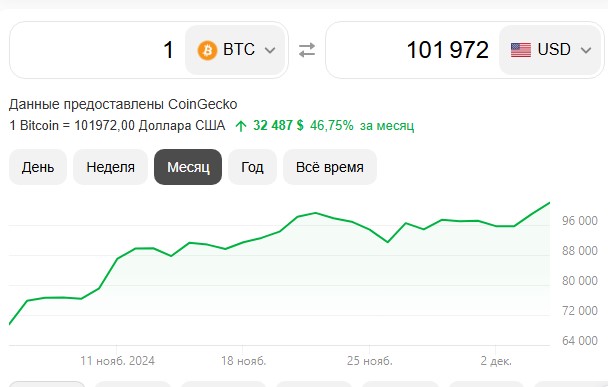

Bitcoin $100,000

Bitcoin broke through the $100,000 mark for the first time, hitting a record of $103,800 amid significant institutional adoption. This rise was fueled by news that BlackRock ‘s Bitcoin ETF manages more than 500,000 BTC. Interestingly, holdings in U.S. spot ETFs nearly reached 1.083 million BTC, underscoring the growing interest from institutional investors in the digital currency markets.

Reasons for Bitcoin’s growth

Political environment

Bitcoin’s rise coincided with Donald Trump’s victory in the US presidential election. Trump, who actively supports cryptocurrency, promised to create more favorable conditions for its use and regulation. This attracted the attention of investors and contributed to an increase in demand for bitcoin.

Institutional investments

Institutional investors, such as BlackRock, have started to invest heavily in bitcoin, which has also contributed to the rise in its value. BlackRock’s management of more than 500,000 BTC ETFs was a landmark event indicating significant adoption of the cryptocurrency at the institutional level.

Spot ETFs

U.S. spot ETFs have nearly surpassed Satoshi’s bitcoin holdings, indicating a growing interest in cryptocurrencies from major financial institutions. It also confirms that the cryptocurrency market is becoming more mature and attractive for investment.

Expert opinions

The head of the US Federal Reserve Jerome Powell characterized bitcoin as “gold, only virtual,” which emphasizes its status as a safe haven asset in the face of economic uncertainty. This statement may also further increase interest in bitcoin as an alternative investment instrument

Conclusion

Breaking through the $100,000 mark and further rising to $103,800 underscores an important moment in Bitcoin’s history. Increased institutional investment and positive changes in the political environment create a solid foundation for further growth of the cryptocurrency. Investors continue to monitor market developments and expect new records in the future.