Bernstein analysts named the key drivers of bitcoin’s growth to $200,000 in 2025

Analysts at Bernstein have provided their predictions on what could push bitcoin towards the $200,000 mark as early as 2025. Key factors include changes in the U.S. regulatory environment that could occur with the arrival of the new Donald Trump administration.

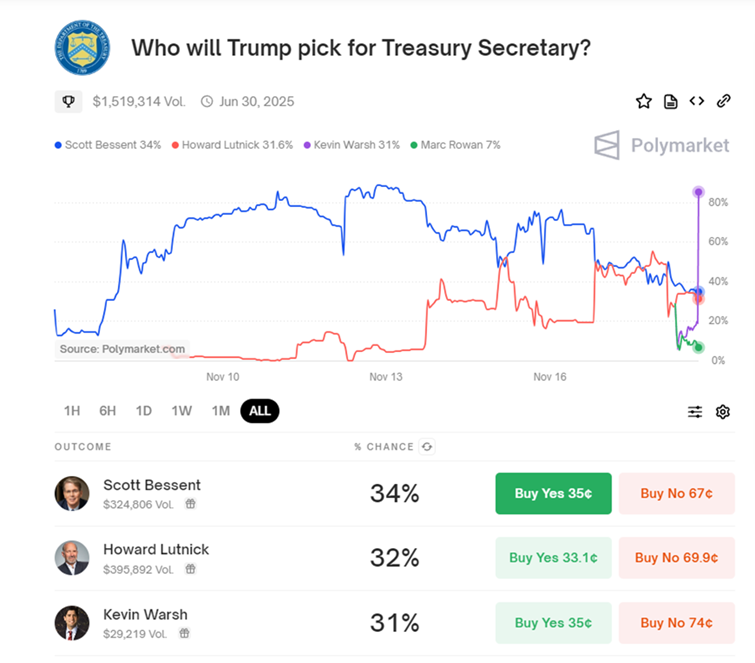

Experts point out that the appointment of new heads of such agencies as the SEC and the Treasury Department will play an important role. Among the main candidates for the post of finance minister are Cantor Fitzgerald CEO Howard Lutnick, known for his sympathies for bitcoin, and hedge fund manager Scott Bessent, who has secured the support of Ilon Musk and other influential figures.

Bernstein emphasizes that in this cycle, not only traditional investors, but also sovereign wealth funds may enter the bitcoin market, which will significantly change the balance of power in the market. Analysts note that the “seeds” of future growth have already been laid, and the interest of such players may become decisive.

Among the expected changes in regulation are creating favorable conditions for bitcoin mining in the U.S., improving energy policy, and simplifying the regulatory framework for cryptocurrency projects. It is also expected that the SEC’s work will be revised in favor of deregulation and transfer of some powers to the CFTC.

The shift to more active digital asset management, including new investment funds, and acquisitions of large companies like MicroStrategy could be additional growth drivers. Bernstein advises investors to be prepared for long-term investments in bitcoin and cryptocurrency-related stocks over the next 12-18 months, emphasizing that we are on the cusp of a new era of digital gold.